Manage your account anytime

In the fast-paced digital era, the ability to manage your financial accounts anytime, anywhere is a game-changer. This guide empowers you with strategies and tools to seamlessly oversee your accounts, ensuring you have control and access to your financial information whenever you need it.

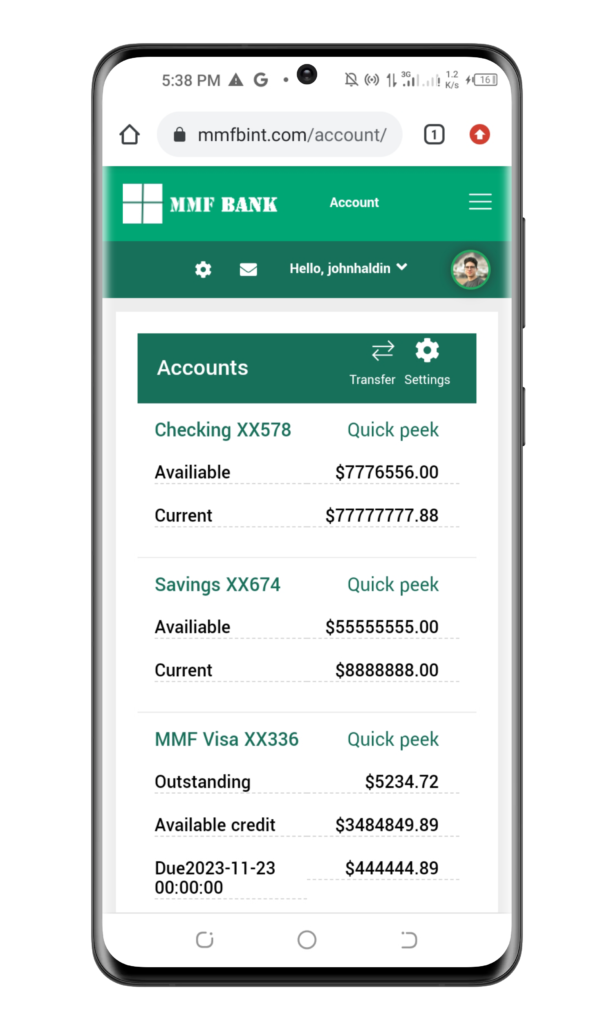

Step 1: Embrace Online Banking

- Set Up Online Banking: If you haven’t already, enroll in online banking services offered by your financial institution. This allows you to access your accounts, check balances, and conduct transactions from the convenience of your computer or mobile device.

- Explore Mobile Banking Apps: Download and install your bank’s mobile app. These apps often provide additional features such as mobile check deposit, account alerts, and secure messaging.

Step 2: Establish Account Alerts

- Customize Alerts: Take advantage of account alert features to receive notifications about important account activities. Set up alerts for transactions, low balances, large withdrawals, and more.

- Security Alerts: Enable security alerts for any changes to your account settings, password updates, or suspicious activities. This adds an extra layer of protection to your accounts.

Step 3: Automate Routine Transactions

- Set Up Automatic Transfers: Automate regular transfers between your accounts, such as moving money into savings or making loan payments. This ensures consistency in your financial habits.

- Schedule Bill Payments: Utilize automatic bill pay services to schedule recurring payments for bills. This helps avoid late fees and ensures timely payments.

Step 4: Monitor Transactions Regularly

- Frequent Account Check-Ins: Make it a habit to regularly check your account transactions. This not only keeps you informed about your spending but also allows you to quickly identify any unauthorized activities.

- Review Statements: Periodically review your bank and credit card statements. This detailed examination ensures accuracy and helps you identify any discrepancies or fraudulent charges.

Step 5: Secure Your Accounts

- Strong Passwords: Use strong, unique passwords for your online banking accounts. Update them regularly and avoid using easily guessable information.

- Two-Factor Authentication (2FA): Enable two-factor authentication whenever possible. This adds an extra layer of security by requiring an additional verification step beyond your password.

Step 6: Explore Financial Management Tools

- Personal Finance Apps: Consider using personal finance apps that aggregate your financial accounts in one place. These apps provide an overview of your financial health, budgeting tools, and spending insights.

- Budgeting Software: Explore budgeting software that allows you to categorize expenses, set financial goals, and track your progress. Many platforms sync with your accounts for real-time updates.

Step 7: Contactless Payment Methods

- Mobile Wallets: Explore mobile payment options and set up mobile wallets on your smartphone. These platforms offer a secure and convenient way to make purchases without physical cards.

- Contactless Cards: If your bank provides contactless debit or credit cards, use them for a faster and more secure payment experience.

Step 8: Utilize Customer Support Channels

- Online Chat and Messaging: Take advantage of online chat and messaging services provided by your bank. These channels offer quick responses to inquiries and assistance with account-related questions.

- 24/7 Customer Support: Familiarize yourself with the 24/7 customer support options. Knowing how to reach your bank’s support team ensures assistance is available whenever you need it.

Conclusion:

Managing your financial accounts anytime is about leveraging the digital tools and services at your disposal. By embracing online banking, setting up alerts, automating routine transactions, and utilizing additional financial management tools, you gain control over your financial information and transactions. Stay vigilant, secure your accounts, and explore the evolving landscape of digital finance to make the most of anytime account management.