Easy access savings account

In the ever-evolving landscape of personal finance, an easy access savings account stands out as a versatile tool for individuals seeking simplicity, liquidity, and a reasonable return on their savings. This blog explores the key features and benefits of easy access savings accounts, shedding light on why they are a popular choice for many savers.

- Instant Accessibility: The hallmark of an easy access savings account is its immediate accessibility. Account holders can withdraw or deposit funds at their convenience without facing the restrictions commonly associated with fixed-term accounts. This flexibility makes it an ideal choice for individuals who value liquidity.

- No Fixed Terms or Penalties: Unlike fixed-term accounts that may require a commitment for a specified duration, easy access savings accounts come with no fixed terms. This means savers can dip into their funds whenever they need without incurring penalties, providing unparalleled flexibility in managing their finances.

- Competitive Interest Rates: While easy access savings accounts may not offer the highest interest rates in the market, they generally provide competitive rates compared to standard checking accounts. This makes them an attractive option for individuals who want to earn some interest while keeping their funds readily available.

- Low or No Minimum Deposit Requirement: Many easy access savings accounts have low or no minimum deposit requirements, making them accessible to a broad range of savers. This feature is particularly beneficial for individuals who may not have a substantial amount to initiate their savings journey.

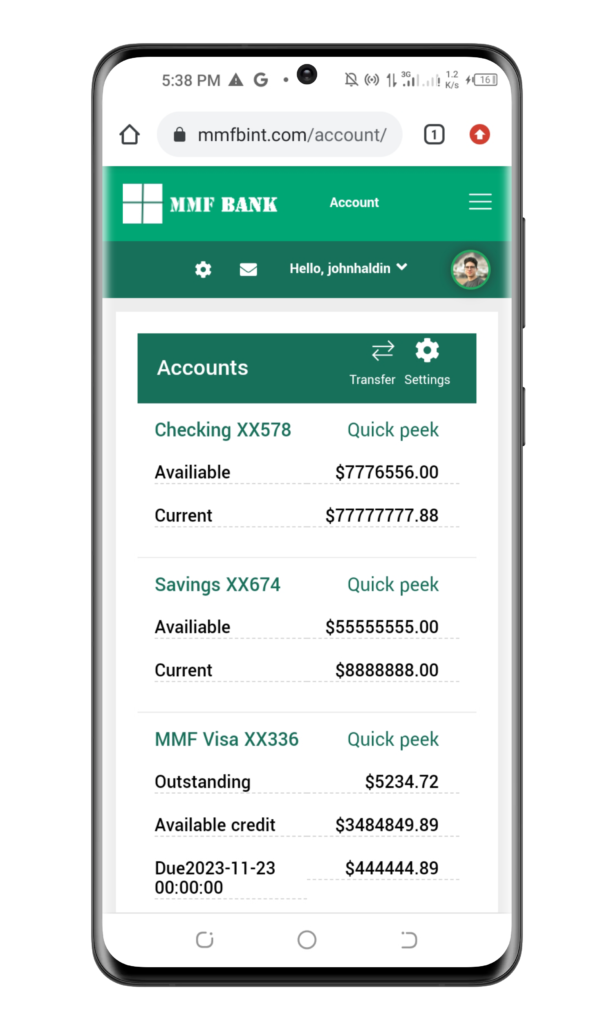

- Online and Mobile Banking Convenience: Easy access savings accounts are often associated with modern conveniences, including online and mobile banking. This enables account holders to manage their funds, track transactions, and monitor interest accrual from the comfort of their homes or on-the-go.

- Security and Regulatory Protection: Reputable financial institutions offering easy access savings accounts adhere to strict regulatory standards, providing a level of security for account holders. Deposits in these accounts are typically insured up to a certain limit, offering peace of mind in turbulent financial times.

- Emergency Fund Building: The instant accessibility of funds makes easy access savings accounts an excellent choice for building emergency funds. Whether unexpected medical expenses, car repairs, or other unforeseen circumstances arise, account holders can readily tap into their savings without delay.

- Regular Contributions and Withdrawals: Savers can contribute to and withdraw from their easy access savings accounts regularly. This feature accommodates individuals with varying financial needs, allowing them to adapt their savings strategy based on changing circumstances or goals.

- Interest Paid Regularly: Interest accrued in easy access savings accounts is often paid regularly, providing account holders with a consistent stream of passive income. While the interest rates may not be the highest, the steady accrual adds to the overall appeal of these accounts.

- Educational Resources and Support: Many financial institutions offering easy access savings accounts provide educational resources and customer support. This assists savers in making informed decisions about their finances, understanding interest rates, and maximizing the benefits of their savings accounts.

Conclusion: An easy access savings account is a practical and user-friendly financial tool that aligns with the evolving needs of modern savers. Its combination of accessibility, flexibility, and competitive interest rates makes it a popular choice for those seeking simplicity in managing their savings while maintaining the potential for modest financial growth.