In Banking, Sustainability is the New Digital

In an era dominated by digital innovation, the banking sector is undergoing a profound transformation. While digitalization has been a key driver of change, a

A penny saved is a penny earned

In the dynamic realm of modern finance, Open Banking stands out as a transformative force, ushering in an era where collaboration takes center stage. This blog explores the concept of Open Banking and emphasizes how partnerships are not just beneficial but essential in navigating this innovative landscape.

Conclusion: In the landscape of Open Banking, partnerships aren’t just a strategic choice; they are fundamental to success. Traditional banks, fintech innovators, and regulatory bodies must work hand-in-hand to harness the full potential of Open Banking. As the financial industry embraces collaboration, Open Banking becomes a powerful catalyst for innovation, customer-centric solutions, and a more inclusive financial landscape.

In an era dominated by digital innovation, the banking sector is undergoing a profound transformation. While digitalization has been a key driver of change, a

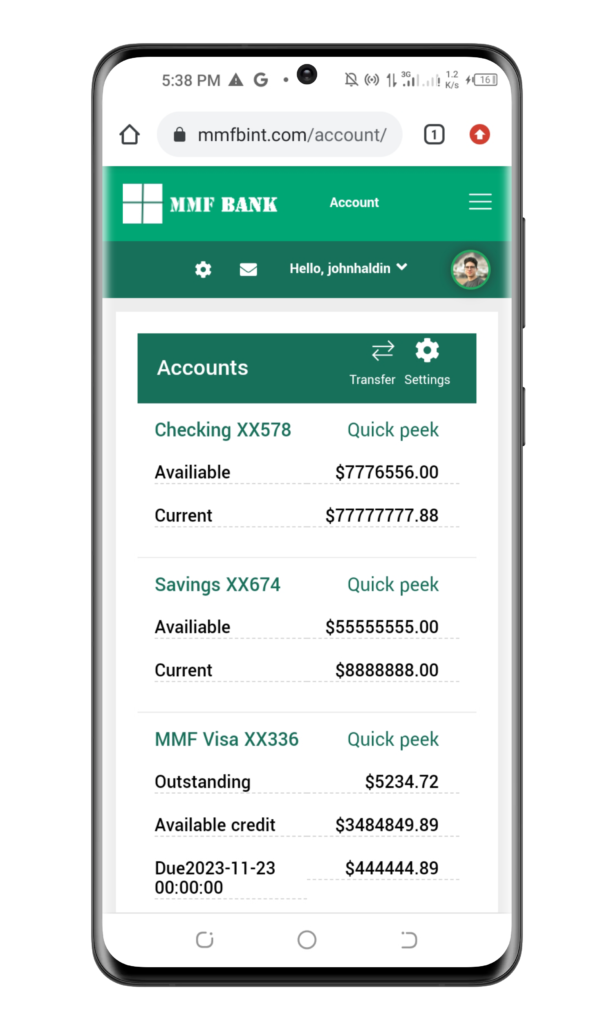

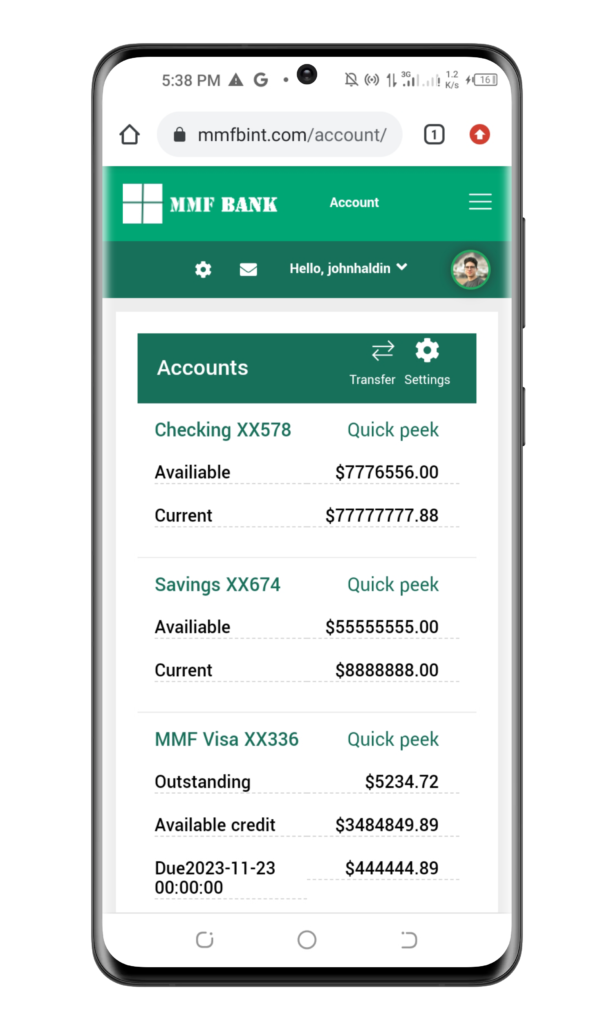

In a world where smartphones have become extensions of ourselves, the magic of mobile payments is revolutionizing the way we handle transactions. From the convenience