In Banking, Sustainability is the New Digital

In an era dominated by digital innovation, the banking sector is undergoing a profound transformation. While digitalization has been a key driver of change, a

A penny saved is a penny earned

In the pursuit of more effective and equitable tax systems, the role of payments data is emerging as a powerful ally. This blog delves into the potential of payments data in bridging the tax gap, exploring how the insights derived from digital transactions can contribute to enhanced tax compliance and revenue collection.

Conclusion: Payments data emerges as a formidable ally in the ongoing battle to bridge the tax gap. By harnessing the insights embedded in digital transactions, governments can create more effective and equitable tax systems, ensuring that everyone contributes their fair share to support essential public services and infrastructure. Responsible use of payments data represents a pivotal step toward a transparent, accountable, and resilient tax ecosystem.

In an era dominated by digital innovation, the banking sector is undergoing a profound transformation. While digitalization has been a key driver of change, a

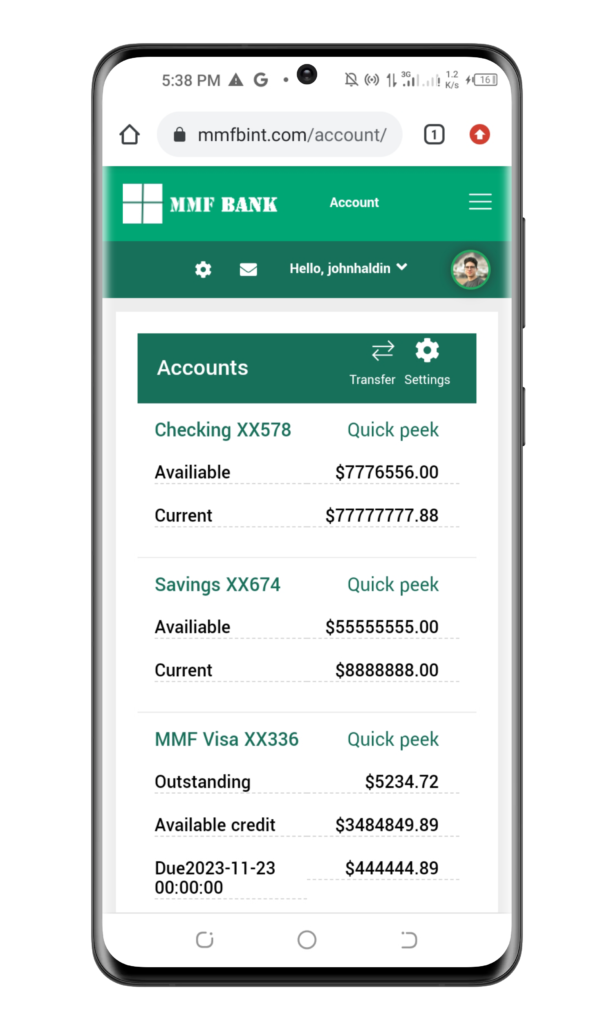

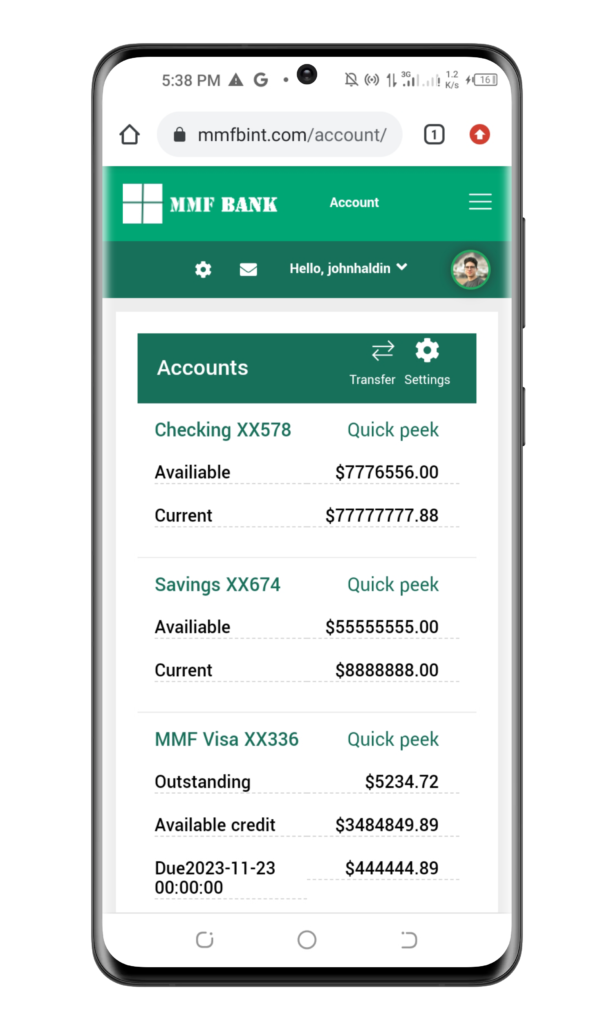

In a world where smartphones have become extensions of ourselves, the magic of mobile payments is revolutionizing the way we handle transactions. From the convenience