In Banking, Sustainability is the New Digital

In an era dominated by digital innovation, the banking sector is undergoing a profound transformation. While digitalization has been a key driver of change, a

A penny saved is a penny earned

In the fast-evolving landscape of finance, the credit value chain stands at the forefront of transformation. This blog explores the dynamic shift towards digital innovation throughout the credit value chain and how financial institutions are revolutionizing their processes to stay ahead in the digital era.

Conclusion: As the financial landscape undergoes a digital revolution, embracing innovation across the credit value chain is no longer an option but a strategic imperative. The integration of advanced technologies not only enhances efficiency and risk management but also transforms the customer experience. Financial institutions that proactively adopt and adapt to digital innovations will undoubtedly lead the way in shaping the future of finance.

In an era dominated by digital innovation, the banking sector is undergoing a profound transformation. While digitalization has been a key driver of change, a

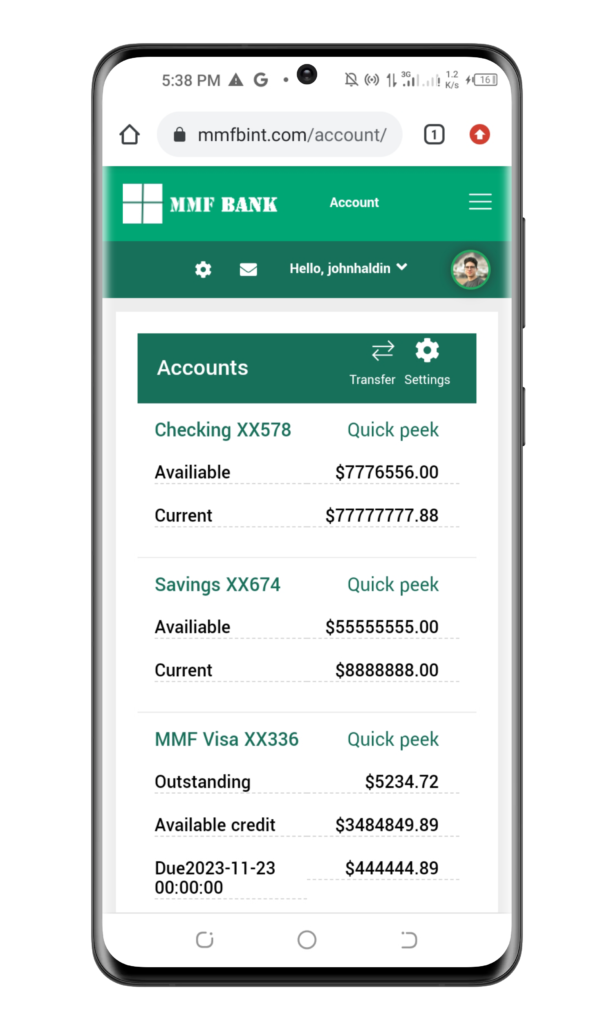

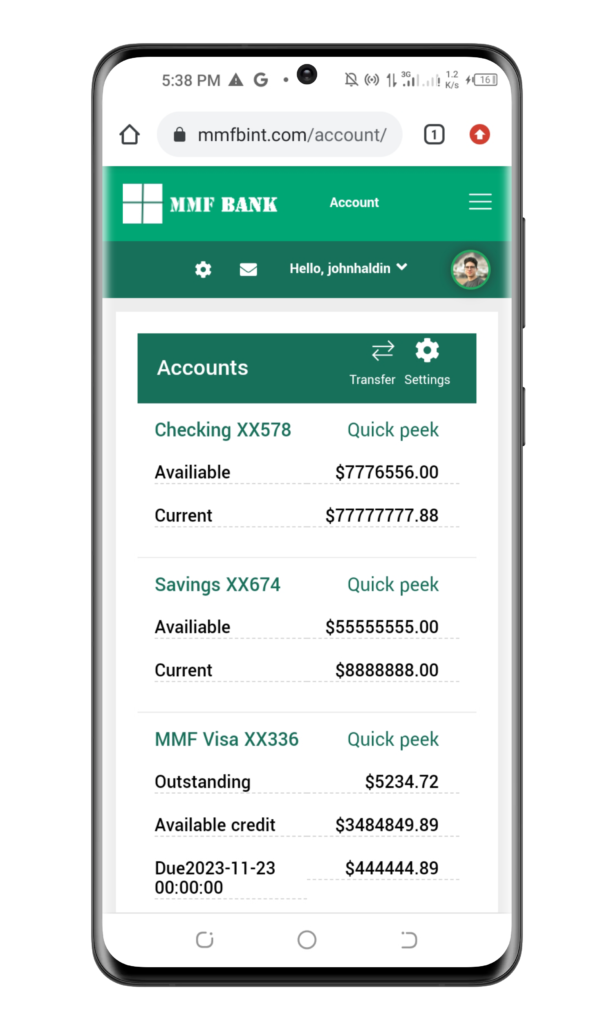

In a world where smartphones have become extensions of ourselves, the magic of mobile payments is revolutionizing the way we handle transactions. From the convenience